A little update on the portfolio performance — my RH account hit 90% one year return for the first time since I started investing in August 2019. This is up from 63% on August 20, 2020 when I posted the last article about introduction to amateur investors.

Trade the volatility – the overreactive dip

Knowledge is power. If you can gain access to certain information before the majority of the investors, you can make a winning decision in the market. This would be useful if we were investing in biblical markets, without the Internet or hyperspeedy CPU. The reality is that institutional trading programs, or trading bots, are specifically dedicated to make split-second decisions to trade upon any available relevant information — just ask how many times the market has reacted to President Trump’s tweets literally within seconds. As a result, there is no legitimate pathway for any specific investor to gain access to any information before the market does. Notably legitimacy is the key word — as long as you are not some congress people who dumped majority of their portfolio after learning about the impeding economic devastation from COVID-19 in a classified briefing. There is a special place in hell for people who cheat the market like that.

The involvement of trading bots, in my opinion, guarantees a more leveled playing field for all investors. However, one of the downsides of trading bots is that they tend to overreact, especially if pertinent information is perceived as negative or simply “not good enough”. This is why the drop is almost always precipitous. Subsequently, it takes some time – minutes to a day – for the price to correctly reflect the market sentiment, resulting in a mini “V shape” recovery.

During a tumultuous trading session when the quarterly earning’s report is not quite as anticipated, the market tends to react in a bizarre fashion with an outrageously wide spread. This is the result when all trading bots are actively trying to figure out what is going on. As retail speculators, we could use these trading bot confusions to our advantage if we could anticipate and scoop the “overreactive dip” as well as the lower end of the spread.

Here are some personal examples.

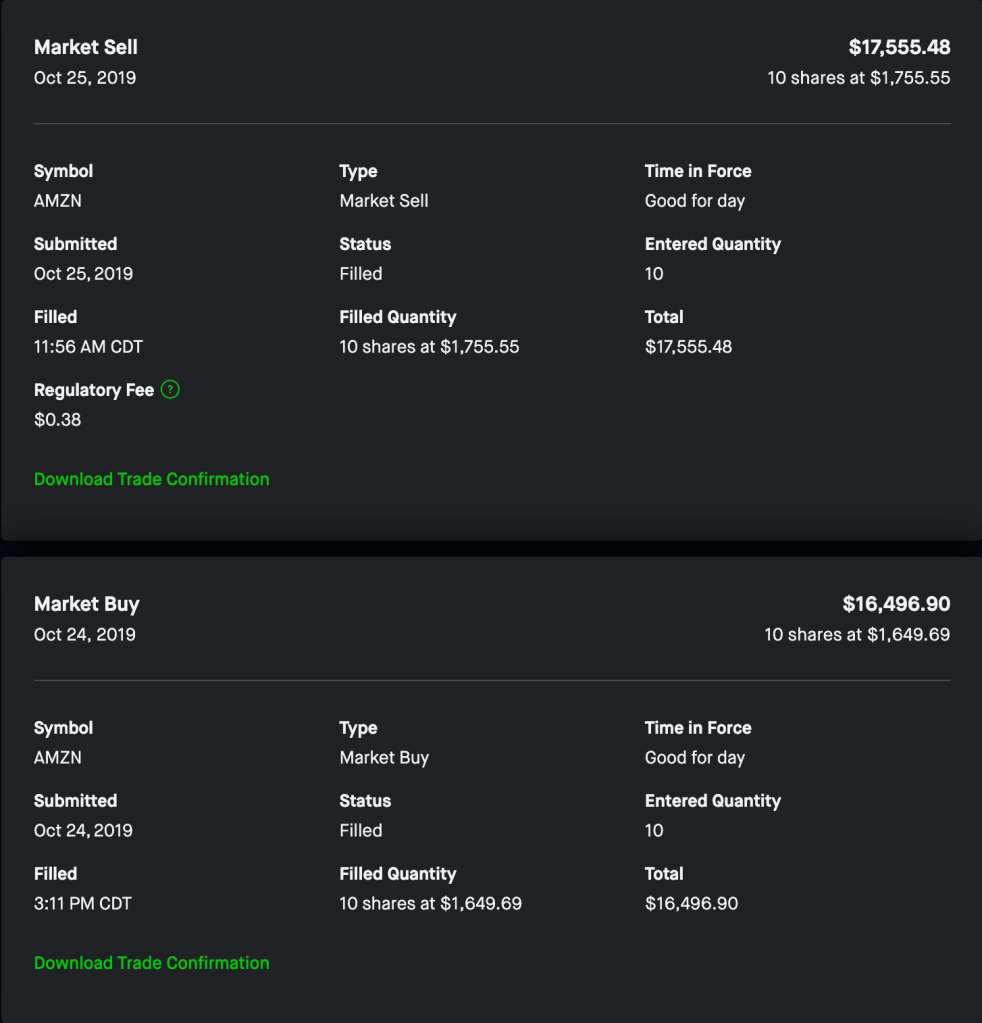

On October 24, 2019 AMZN released a small beat on EPS afterhours, the market went into a frenzy. It closed around 1780 that day. Immediately afterwards, the price dipped 7% with a spread so wide that I was able to scoop up 10 shares at 1650. The decision to buy was simple – the earning report was strong; it was just not good enough for some bots. Once a few bots started dumping large positions, it triggered an avalanche. Surely enough, the next day AMZN closed at 1761 — a merely 1% drop from previous close. I sold my position around 1755 next day, netting $1050 in a one day swing trade.

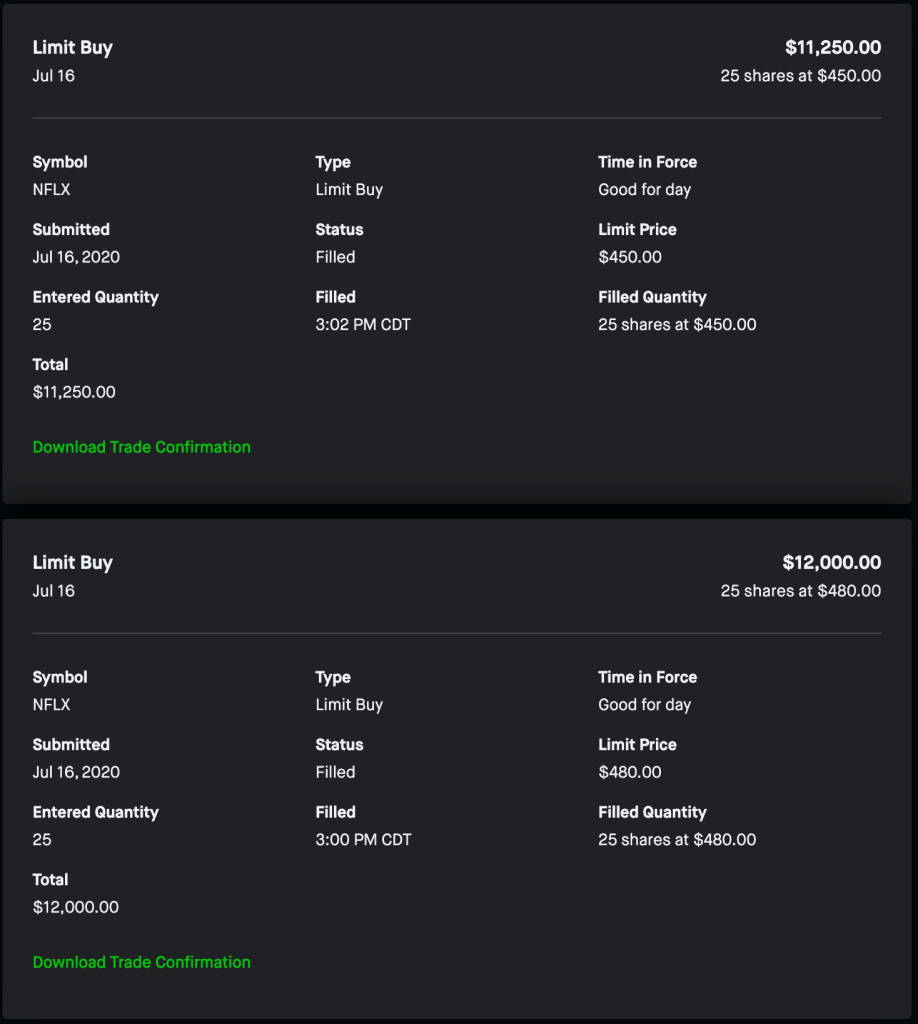

On July 16, 2020 NFLX released a miss on EPS but all-around beat with global new and paying subscribers. The market reaction was even crazier — a 15% drop at the lowest. NFLX closed at 527 but I was able to dip in 25 shares at 480 and another 25 shares at 450. Only the next day, NFLX opened at 495 with a high of 503 while I sold all my positions mid-day at 497. This swing trade netted me $1600.

In order to capture the “dip” in such scenarios, a limit order spread is recommended. Depends on your risk tolerance and the anticipated scope of the dip, you can set up a tier of limit order at 5%, 10% and 15% etc and allow for trading at extended hours. Robinhood allows such orders but sometimes the stock exchange might reject them due to big price difference. All you gotta do is to try again until your order is queued.

This “overreactive dip” technique works best when the short-term volatility of the stock is high. The best indicator for that is the Vega value of the ATM option expiry immediate after the earnings date. While there is the reversed tip if the stock gapes up, I personally do not condone short-selling. I think it should be illegal. Bottomline is, the risk is low and manageable. If your prediction is wrong and the stock rallies following the earnings, your limit order will not be filled and you could just write this one off as a missed opportunity. The only scenario where you lose money is when the stock crashes so hard that it does not come back. This could easily be avoided by picking the right stocks — a large cap company with established profitability and growth. My personal favorites are NFLX, TSLA and AMZN, and SPOT for this particular technique.